A Focus on Sectors

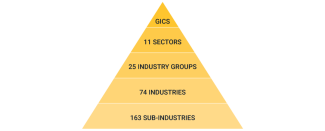

There are several different ways to construct an equity or stock portfolio, including the more traditional approaches of market cap (large, medium or small), style (growth or value) and location (geography). The general acceptance of these approaches may be changing as recent long-term studies of historical stock market returns suggest that industry sectors may be a more important contributor of equity returns than market cap, style and geography combined. As defined and used in this context, a sector is an industry classification or grouping of companies sharing common characteristics. The most common classification of industry sectors, the Global Industry Classification Standard or GICS, divides the equity universe into 11 major sectors (Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Information Technology, Materials, Real Estate and Utilities), 25 Industry Groups, 74 Industries and 163 Sub-Industries.

We think a focus on industry sectors can provide a clearer understanding of where stock price returns are generated. Sectors provide many benefits, including their static composition, clear patterns of volatility and low correlation with each other. While a company’s market cap or style grouping can change, its’ sector classification rarely does so. Sector classification provides a reliable and flexible framework that can be applied to companies globally resulting in a clear and understandable approach to defining industries and classifying securities by industry. Because sector performance is typically tied to economic cycle conditions, sectors have clear corresponding patterns of volatility. Some sectors like Consumer Discretionary, Information Technology and Materials are more volatile than the broader market and others (Consumer Staples, Health Care and Utilities) are less volatile. As an economy moves through a cycle, sectors will often perform differently causing them to move out of sync with each other. For example, Information Technology and Consumer Staples have low to moderate correlation (0.34 to 0.38), which means that their stock prices will move in the same direction (up or down), but at different speeds. Remember, when we construct a portfolio with assets that have low correlation, overall portfolio diversification is improved.

A sector rotation strategy provides an efficient means to adjust equity weightings within a portfolio based on an understanding of where we are in the current economic cycle. A typical cycle has four distinct phases: Early (rebounding economy with strong earnings growth), Mid (credit expands, earnings are strong and economic growth peaks), Late (economic growth moderates, credit tightens and earnings decline) and Recession. History teaches us that sector performance can vary significantly depending on the stage of the economic cycle. Early-stage outperformance is often seen in Consumer Discretionary, Financials, Industrials and Information Technology. By the time we move through the Mid into the Late stage, we see strong sector performance more from Consumer Staples, Energy, and Materials. In Recession, we might expect above market returns from Consumer Staples, Health Care and Utilities.

We think that the implementation of a sector rotation strategy within an equity allocation can bring precision to your portfolio. Sector investing eliminates the decision of which stock within a sector you should invest in. If you believe that we are in the Early stage of the current economic cycle (that is our opinion), then you might want to increase your holdings in the Information Technology sector, instead of attempting to decide which individual stock within that sector (for example NVIDIA, Microsoft and Apple) would be the best choice.