Are you a smart investor?

(smärt) adj. 1. keen, clever or shrewd. Also, bright, intelligent, savvy and perceptive. A smart investor exhibits all...

Read More

What is the SECURE Act 2.0?

Buried within the recently passed 4,000-page 2023 omnibus funding legislation was the Secure Act 2.0 which provides new...

Read More

Did the Fed get it right?

At the recently concluded FOMC meeting the Federal Reserve approved an interest-rate increase of 0.5% and signaled plans...

Read More

Let's Talk about Bonds

As defined, a bond is “an interest bearing security that obligates the issuer to pay the bondholder a specified sum of...

Read More

Choosing the Right Investment Advisor

Registered investment advisors (RIAs) come in all shapes and sizes and can be found in a variety of places. Some...

Read More

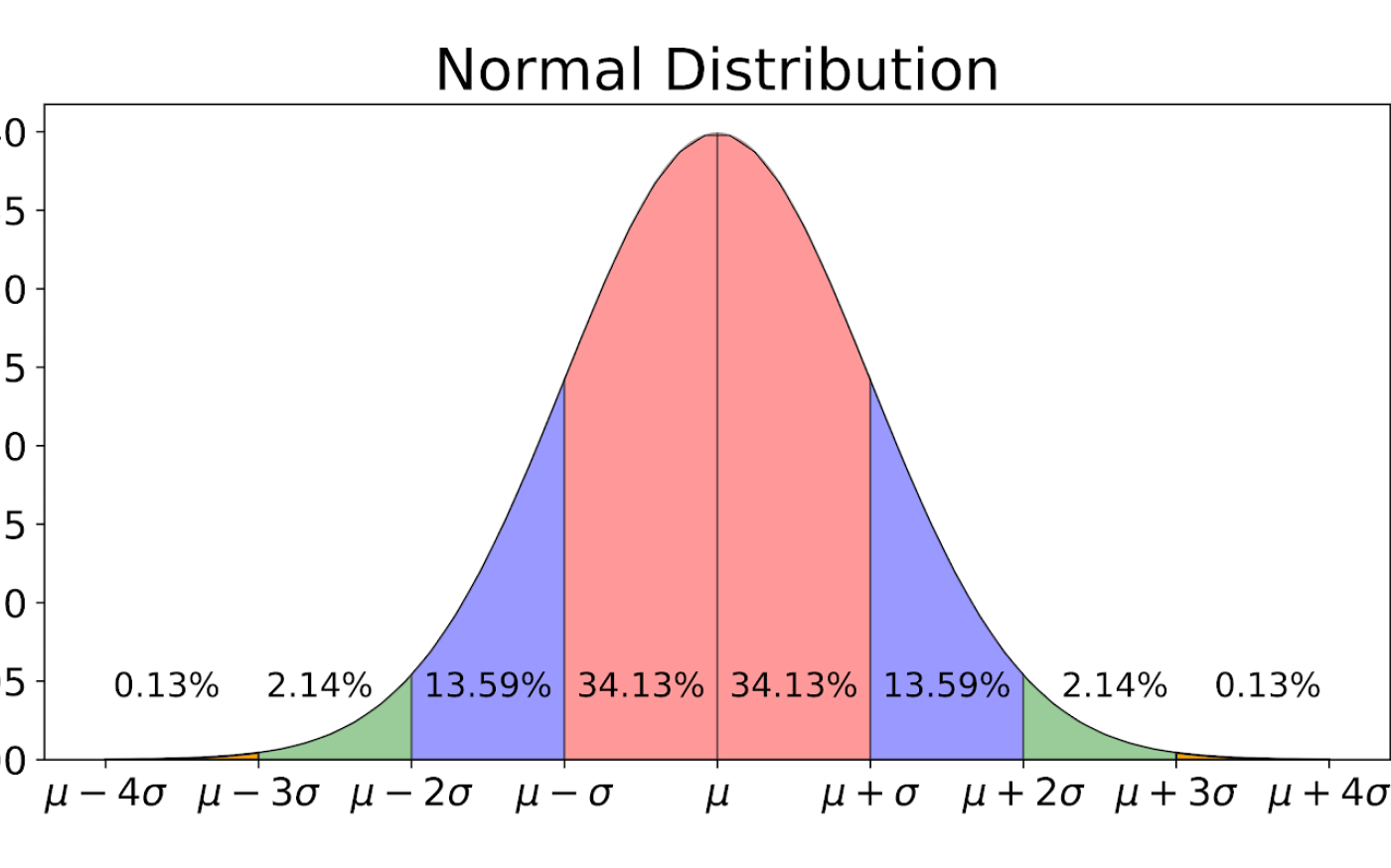

What is Standard Deviation?

As defined, standard deviation “provides a statistical measure of historical investment return volatility and sets forth...

Read More

Investment Risk - Alpha and Beta

Understanding investment risk and how it impacts portfolio performance is essential for all investors. In general, there...

Read More

Investor Outlook - What is next?

In our January newsletter to clients we wrote, “There are several potentially disruptive forces (not including the...

Read More

A Cap-ital Idea

The value of a publicly traded company is often referred to as market capitalization (or market cap) and is calculated...

Read More

Famously Blunt Tools

The words “ famously blunt tools” are not what you would expect to hear the Chairman of the Federal Reserve say in a...

Read More

Should I add Floaters to my Portfolio?

At its March meeting the Federal Reserve, as widely expected, raised its benchmark interest rate by 0.25% (25 bps), the...

Read More

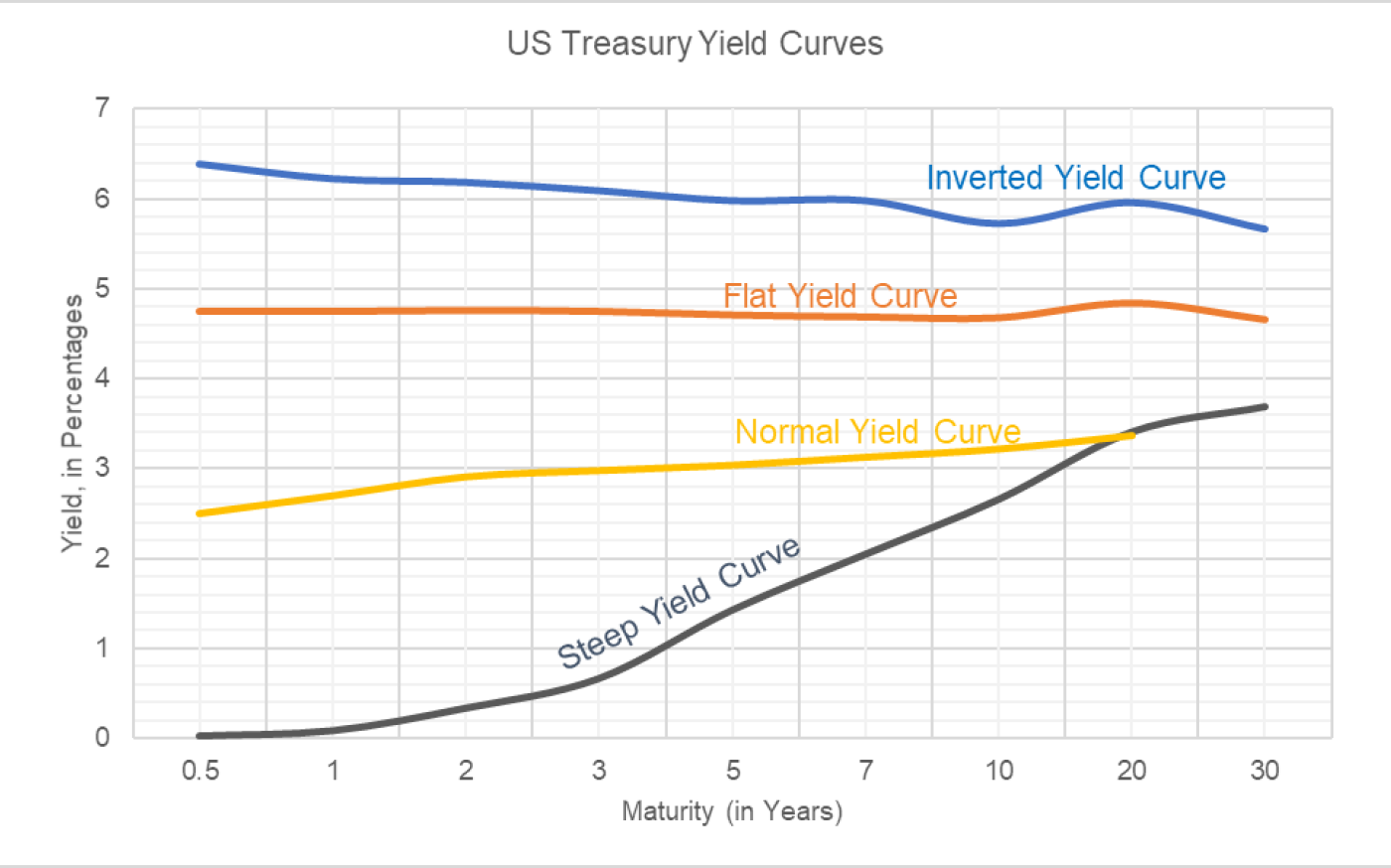

Shapes of the Yield Curve

A yield curve is a graph or plot of interest rates that buyers of government debt demand to lend their money over...

Read More